We have been hearing for years that growth in the Chinese middle class is going to impact demand for Australian farm commodities. In the last year we have been noticing higher lamb and mutton prices, in the face of similar supply. Export data provides some insight into where the demand is coming from, and how the increase in Chinese demand might be becoming a reality.

What is going on with lamb and sheep prices?

We’ve been hearing this quite a bit lately. If we didn’t have slaughter data we might think that supply is tight. We do however know that lamb and sheep slaughter has been as strong as previous years. Basic economic theory tells us that if price is higher, and supply is the same, demand must be stronger.

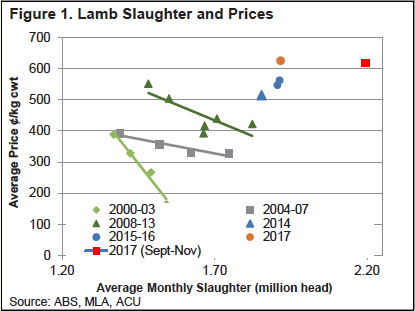

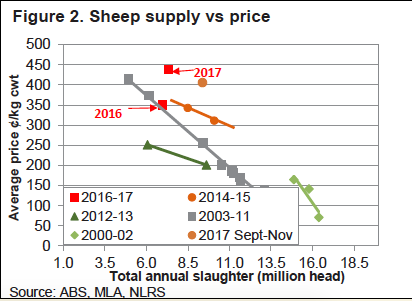

Figures 1 and 2 show price versus supply for lambs and sheep on an annual basis. While we are still waiting for official data, we can however estimate the final figures for 2017, showing prices moving higher, despite similar or larger supply.

Average slaughter, along with price are shown on the lamb chart. While slaughter is much higher than the annual average, prices have remained steady. For mutton we have converted slaughter for September to November period to an annual figure. While the average price for September to November has been slightly lower than the annual average to date, supply has been much stronger. Usually this translates to a weaker price during the Spring peak, but not in 2017.

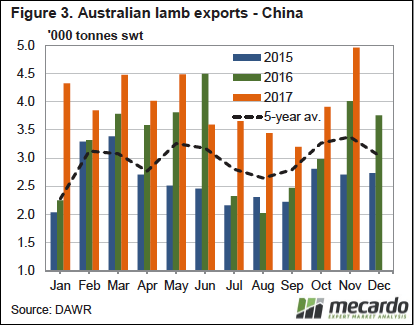

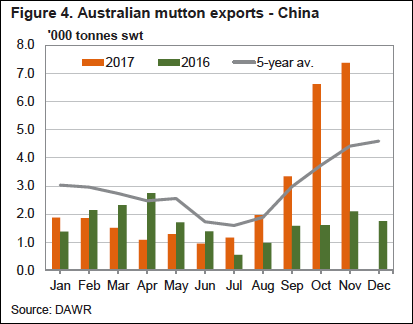

Figures 3 and 4 show where the stronger demand is coming from. Lamb exports to China have been 28% higher than last year for the last three months. The shift in mutton exports is more extraordinary. From September to November Australian mutton exports to China were up 227%, with China becoming easily our largest destination.

There is little information available as to what is driving the increased sheep meat demand from China, or whether it is going to last. There is, however, little doubt that Chinese demand is forcing other export markets, and the domestic market, to pay what are normally mid-winter prices for sheep and lambs in the middle of the spring flush.

[key_points]What does this mean?

Sheep growers will know that just because Chinese demand is strong now, it doesn’t mean it will continue. The wool market has long been subject to fluctuating demand from China, and this tells us that the stronger lamb and mutton demand may not be here to stay, so it might be wise to take advantage of the good prices while they are available.

The good news is that the strong demand is removing plenty of sheep and lambs from the system, which will in turn see supply tighten. As such, even if Chinese demand wanes, prices might hold. And if Chinese demand remains strong, and we see weaker supply, 2018 could see new records.

Mecardo is Australia’s leading agricultural commodity risk management advisors and market intelligence experts. Mecardo delivers the expertise of advisors and other market intelligence experts in a concise, easy-to-read format.

It doesn’t just report the market news – Mecardo explains what’s driving the market, helps to understand what’s important and what it means for the reader.

The client base of Mecardo is spread across the agricultural landscape, including producers, processors and consumers of Australian agricultural commodities, both domestically and internationally.

For more information visit our website at www.mecardo.com.au, or contact us on ask@mecardo.com.au