Primary producers spend a great deal of time developing strategies to maintain the viability of their business. Very few businesses are subject to the same risk exposures as the farming community.

Knowing when to spend money and to save money becomes a balancing act. Inevitably, the question of whether to insure or not to insure farm assets comes up and forms part of the grower’s risk assessment analysis. Insurance is often viewed as an unwanted expense, rather than a means of sharing the risk of loss with another party.

The key driver of farming income is the crop and the key risk factor to growers is the weather, loss of revenue and servicing debt. In the past, there has only been the traditional hail and fire damage policies available, however over the past two to three years new insurance products have come on to the market and there are now a variety of insurers and policy options available to growers. Ausure summarises some of the key aspects of these multi-peril policies in comparison to traditional crop policies and evaluates the risk exposures to growers.

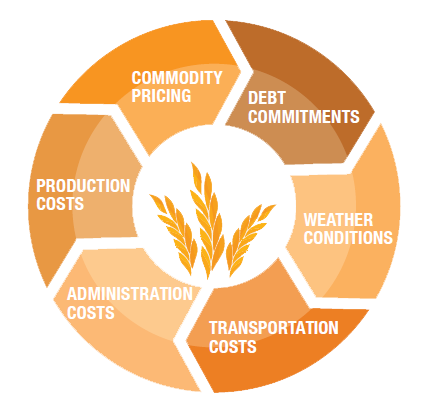

Financial risk exposure

Variations in rainfall and temperatures from one region to another can change dramatically. When comparing rainfall and temperature for the winter periods 2015 to 2017, the risk associated with crop loss from weather events is becoming increasingly apparent. One grower can have 10mL of rain and their neighbour 1mL or none. This volatility undoubtedly impacts on the grower’s ability to forecast cash reserves and limit financial stress. It becomes a question of – will I or won’t I plant a crop?

Offsetting the risk

A total crop loss or even partial crop loss can be catastrophic to the grower. Finance companies still require loan payments, equipment still needs to be purchased and maintained, irrespective of the weather. Crop insurance is one method of offsetting the grower’s financial risk exposure from weather events.

Selecting the most suitable policy will depend on the grower’s risk exposures and of course a cost benefit analysis.

Insurance cover may only be available for some crops. As an example, cover for winter crops can include: wheat, barley, oats, triticale, hay, canola, chickpeas, faba beans, lentils, field peas, vetch, and lupins.

Some insurers may only offer cover on some of these crops or variety of crops in some states. Summer crops are not included (cover may be limited or not available for summer crops). Check with your Ausure adviser.

Cost benefit analysis – comparing the policies

Similar to the type of crop the insurers will cover, the insurers will also analyse their exposure and assess which peril/s they are prepared to cover. Undertaking a comparison of the options available and the growers highest risk exposure is important. The following is a list of insurable risk exposures:

- Fire*

- Drought

- Water Stress

- Heat Stress

- Hail*

- Flood

- Excessive Wind

- Excessive Rain

- Hurricane

- Frost

- Lightning

- Snow

- Chemical Overspray (Ground)*

- Cyclone

- Tornado

- Wildlife Damage

- Insect or Pest Manifestation

- Plant Disease

- Livestock Damage

*Insurers will have a cut-off date for renewal offers (generally January 2018)

Not all the above risk exposures will be covered by one insurer under one policy. It is important to understand exactly what perils are being covered by the insurer.

Comparing the policies – premium costs

It is important to know crop insurance can be affordable. As mentioned, insurance is about risk distribution between the insured and the insurer. In the case of crop insurance, some insurers allow the grower to choose how much of the risk they want to carry themselves and how much of the risk they want to pass to the insurer. This allows the grower the opportunity to at least cover part of their crop if financial constraints are a problem.

Insurers will have varying premium rates, methods of assessing their risk, and different policy wordings.

It is essential when making the decision to insure that there is a full understanding of the policy coverage and any limitations.

Your local Ausure adviser can provide this information and assist you in sourcing suitable cover and obtaining quotations from a variety of insurers.

Cost benefit analysis – weighing the factors

Weighing up the benefits versus the cost will of course depend on several factors in the risk assessment matrix–

- The price per tonne – high/low

- The potential yield – high/low

- Required yield/revenue to remain viable

Versus

- The premium payable

- The potential loss of income from an insurable event

- Costs associated with replanting

- The impact on financial commitments resulting from a loss e.g. interest payments

- The impact on future expansion plans

A summary of some of the options

| Limited Perils | Multi Perils |

|---|---|

| Cover is available for both summer and winter crops (depending on the crop and the region) | Cover is generally restricted to winter crops (depending on the crop and the region) |

| Cover is limited to fire only or fire and hail damage plus some additional benefits and optional benefits | Multiple perils are covered depending on the insurer, the crop and the region |

| Two methods of insuring: Pre-Harvest Revision – insured yield can be adjusted up to the final revision date then locked in This allows the grower to limit the maximum of the sum insured and cost of insurance. After Harvest Declaration – insured yield is adjusted after harvest (20 to 25%) depending on the insurer. This provides greater protection against a potential loss that may arise whilst still capping the maximum of both the sum insured and the cost of insurance. |

Two methods of insuring: Yield Based – based on a reduction in guaranteed yield and guaranteed production resulting from an insured peril. Revenue Based – based on reduction in grower’s revenue resulting from an insured peril. The percentage of cover offered by the insurer is dependent on an assessment of historical data (varying from 5 to 6 years) supplied by the grower to the insurer. This allows both the insurer and grower to complete an analysis of their farm business and projections for the future. Variations – The grower can choose to carry some of the risk by varying the percentage of cover they require and reducing the cost of insurance. Example (based on acceptance by the insurer) Insurer’s risk exposure – 60% Grower’s risk exposure – 40% |

| Application fees are nil | An application fee can vary from nil to $4,400.00 (this is generally a one-off fee and not payable on renewal) Government grant of $2,000 (ex GST) is available on application. Insurer will assist growers in applying for the subsidy. |

| Excess will vary – commonly 5% of the loss | Generally nil |

| Review period – depending on the insurer and the crop | Review period – depending on the insurer and the crop. Renewal options available may have a cut-off date in January. |

The information contained in this article does not taken into account your individual circumstances, goals and objectives.

Please call 1800 603 699 for expert advice from the team at Ausure.

Ausure Ruralco Pty Ltd (ABN 21 167 334 536) is an Authorised Representative of Ausure Pty Ltd, ABN 94 096 971 854 AFSL 238433.