It’s ten years since deregulation of wheat exports in Australia. At the time, there were plenty of doom-mongers predicting the end times were about to come to Australian grain growers. In this article we look to see what has occurred to pricing in the past two decades.

The sky hasn’t fallen in, the crops are going into the ground and for the most part, everyone selling to the export market has been paid. A poll we took in June showed a majority of respondents believed deregulation to be positive.

Admittedly, this was an unscientifically produced survey, it nonetheless marries up with our general anecdotal view from discussions with growers.

It’s not particularly easy to determine whether deregulation was better or worse, as we cannot run the two situations side by side. We do not know whether AWB would make better or worse decisions, and the bad decisions (Oil for food scandal) by AWB were largely responsible for deregulation.

I have thought long and hard about how we can conduct an analysis to determine whether post-deregulation has been better or worse for producers.

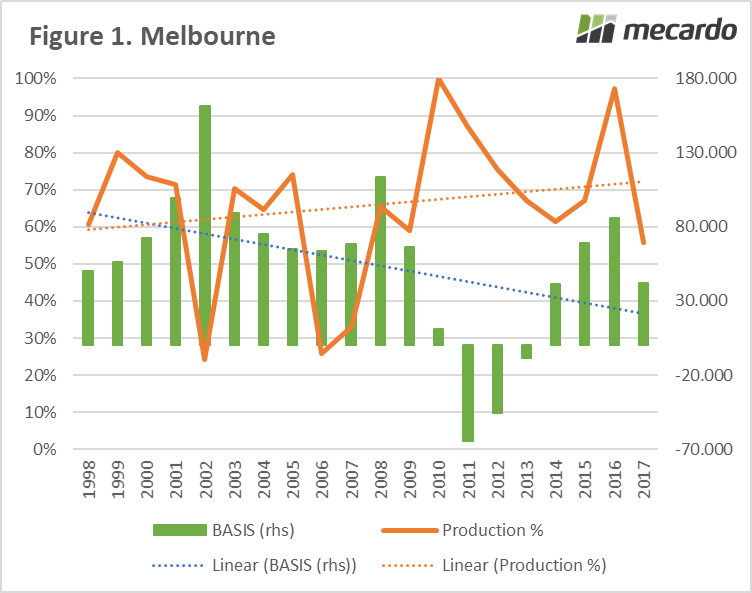

For this analysis, I have examined basis levels and production. Basis, in this case, is the premium or discount for Nov/Jan during each season for our local price (ASW*) against spot Chicago futures. The production is the percentile over the past forty years for both the east and west coast.

As we all know, Australia is a large continent with a strong focus for export on the west and a higher proportion of domestic consumers in the east. In both Melbourne and Kwinana, the ten-year average post-deregulation has been lower than the prior decade (Figure 1 & 2). However, in recent years we have also experienced production at the top end of the range.

During the ten years prior to deregulation, we had the millennial drought, which points towards the reasoning behind higher basis levels during the period.

What does this mean?

It’s difficult to determine whether deregulation was for better or worse. For the most part, it’s down to farmers to judge whether the additional buyers and availability of new tools for managing risk have been beneficial.

The post-deregulation period has seen record crops in Australia, whereas the preceding ten years were some of our worst. In recent years, however, we have received what is considered reasonably strong basis levels at a time of high production.

[key_points]At the end of the day, it’s all academic, as there is no chance of going back to the single desk days. We must just take the opportunities which come to us to get the best returns.

Sources: CME, Mecardo

*ASW was chosen as we have a higher level of pre-deregulation data for this grade.

Mecardo is Australia’s leading agricultural commodity risk management advisors and market intelligence experts. Mecardo delivers the expertise of advisors and other market intelligence experts in a concise, easy-to-read format.

It doesn’t just report the market news – Mecardo explains what’s driving the market, helps to understand what’s important and what it means for the reader.

The client base of Mecardo is spread across the agricultural landscape, including producers, processors and consumers of Australian agricultural commodities, both domestically and internationally.

For more information visit our website at www.mecardo.com.au, or contact us on ask@mecardo.com.au